Bugatti Car Insurance

- Resale ValueCheck in your City

- High Tech System

- Unmatched Power

- Cutting Edge Modern Designs

- Fast and Power-Packed Performance

Top Car Insurance Plans

- CASHLESS GARAGES 8000+

- CLAIMS SETTLED 100%

- ZERO DEP. CLAIMS UNLIMITED

Maximum Cashless Garages

Over Night Vehicle Repairs

24x7 Roadside Assistance

Quick Claim Settlement

- CASHLESS GARAGES 3,100

- CLAIMS SETTLED 95%

- COMPREHENSIVE CLAIMS UNLIMITED

Towing Assistance (For Accidents)

Coverage Outside India

PSU Provider

Quick Claim Settlement

Car Insurance Premium for Bugatti Car Variants

| Car Model | Variant of the Car | Comprehensive Car Insurance | Third Party Car Insurance | Own Damage Car Insurance | |

| Bugatti Veyron | 16.4 Grand Sport | ₹ 2094 | ₹ 7897 | ₹ 603631 | |

| Bugatti Divo | W16 | ₹ 2094 | ₹ 7897 | ₹ 1973589 |

Calculate Bugatti Car Insurance

Select your car brand

- Maruti

- Hyundai

- Honda

- Toyota

- Mahindra

Which city is your car registered in?

- Ahmedabad

- Bangalore

- Chandigarh

- Chennai

When did you buy your car?

About Bugatti

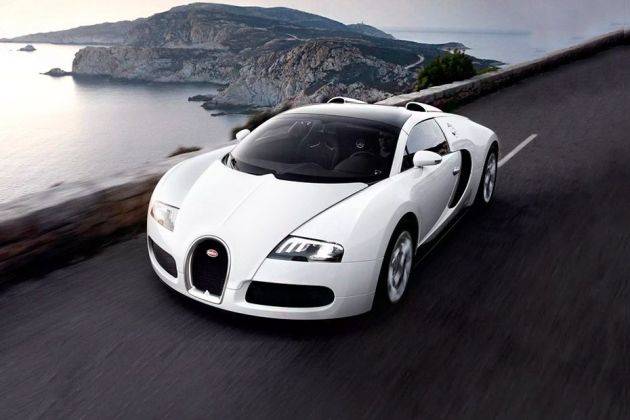

Bugatti was founded in 1909 by Ettore Bugatti who was a French carmaker of high-performance automobiles. Volkswagen Group, which is a German auto giant took ownership of the French automobile firm in the year 2000. Bugatti is ready to enter the Indian market with its Bugatti Veyron, which is the fastest car in the world. The car is considered the fastest and the most luxurious car in the world. It is known for its elegant design, exceptional beauty and for its unparalleled performance that associates it with class, luxury and wealth. The most famous Ettore Bugatti's cars include The “Type 41Royale”, “Type 57 Atlantic” and “Type 35 Grand Prix” and “Type 55” sports cars. The brand is entering the Indian market to add to a prospective buyer’s choices. The Bugatti brand is renowned majorly for its Bugatti Chiron cars and its first offering is likely to be in the Coupe segment.

Bugatti Car Insurance

During the purchase of a Bugatti car, every person should also buy a car insurance plan to secure it. Car insurance shields the insured car as well as the owner-driver from the liabilities arising due to an accident. With the insurance cover, policyholders can get compensation for liabilities you may own towards a third party due to an accident with the involvement of the insured car and expenses incurred due to accident, theft, fire, natural calamities or man-made disasters. Bugatti is known for its opulence, hence, you should opt for car insurance to secure it from uncertainties.

Moreover, like every car owner, it is a compulsion for Bugatti car owners too to own a third party car insurance plan while driving, as per the Indian Motor Tariff. Third-party insurance is the basic insurance cover that secures you from third party liabilities resulting from bodily injuries, death and property damage. Driving without this cover can make you penalised with a fine of Rs. 2,000 or/and imprisoned for up to 3 months. The premium for liability only cover depends on the cubic capacity of the car, while the premium for standalone cover is computed on the basis of the Insured Declared Value (IDV) of the car. The IDV is the highest amount of compensation that your insurer is entitled to offer you in case of an accident or a mishap.

Sometimes, you may feel that the standard car insurance is falling short of protecting your car in some situations. However, to expand the coverage of your car insurance policy for your Bugatti car, you can opt for add-on covers. These insurance covers are optional and you can pick them as per your budget and requirements. Here are some of the most useful add-on covers that you can add to your car insurance policy for your Bugatti car:

- Zero Depreciation Cover: Zero depreciation is an add-on cover that helps shield your car against repair and replacement expenses of rubber, plastic and fibre components of the car without factoring in the depreciation. Without this cover, the insurance company provides you with the compensation after making a standard deduction of depreciation. It can be opted for at the time of policy purchase or renewal by paying an additional premium. It is applicable for those who are not more than five years old and can be used only for a limited number of times in a policy year.

- Roadside Assistance Cover: Roadside assistance add-on cover provides you assistance in situations where your car breaks down in the middle of the road and you are required with the help. Under this cover, various services are offered which secures you from getting stranded on the road. The services offered under this cover comprise towing, fuel delivery, arrangement of taxi service, minor repair and so on. The cover provides help to policyholders within a limited distance as specified in the policy.

- Engine Protection Cover: Under a standard car insurance plan, the insurance company is entitled to cover only damages which are caused during the accident. However, many times the engine of your insurer car could also suffer consequential damages as well, after a mishap or an accident. This add-on cover helps you protect your car against damages sustained by your car’s engine due to the leakage of lubricating oil or when water enters the engine due to some sort of natural disaster and so on.

Car Insurance Renewal Process for Bugatti Cars

The car insurance renewal process for Bugatti cars is quick, easy and hassle-free, especially when it is done online. Every policyholder needs to renew the car insurance policy every year in order to continue to enjoy the benefits of the plan. To keep your Bugatti car protected, you should keep it insured first and renew its car insurance plan every year on time without fail. On this note, here the steps to follow to renew your Bugatti car insurance plan online:

Step 1: Visit the official website of the InsuranceDekho and click on the ‘Car’ option.

Step 2: Enter your Bugatti car’s registration number to proceed. Select the variant and fuel type of your Bugatti car to move ahead. In case you do not know the Bugatti car’s registration number, then you must click on the ‘Don't know your car number?’ tab and choose the brand, model, variant, registration year, registration city, and RTO, to proceed.

Step 3: Enter the expiry date of your last car insurance policy and your previous insurance company. Also, share if you raised any car insurance claim during the previous policy year or not and then click on the ‘Continue’ tab to move ahead.

Step 4: Fill up the personal details like name and mobile number. Also, enter the duration for which you wish to buy a car insurance plan and click on the ‘Submit and Get Quotes’ button.

Step 5: Several car insurance policy premium quotes provided by different insurance companies will appear on your screen. You need to compare and select the car insurance policy quotes that suit you the best based on your needs and budget. You can also opt for some add-on covers in your plan at this step.

Step 6: Click on the ‘Buy Now’ button and confirm all the entries before going further to the payment process for the renewal of the car insurance plan. Make payment through different payment gateways like debit cards, credit cards, digital wallets, net banking, etc. Once the payment is done, the revised car insurance policy will be issued and will be sent to you at your registered Email ID.

Claim Cashless Car Insurance For Bugatti Cars

When it comes to making claims for car insurance, cashless claims are the best option for policyholders. It allows you to get your Bugatti car repaired without making any payment at the network garage of your insurance company. To get this service, you should intimate your insurance company about the damage and loss sustained by your car at the earliest after a mishap. This cashless facility will help you get your car repaired free of cost as your insurer will be bearing the expenses directly with the garage.

It is quite a beneficial option as it makes you free from paying any amount for repair soon after an unfortunate incident. This claim facility requires very little documentation or formalities to go through that expedites the process. A surveyor is sent by your insurer to examine the extent of damage which makes the process faster and transparent. The insurance companies add the best garages to their network with which you get the opportunity to get your Bugatti car repaired at the best service centre without paying anything.

Renew Expired Policy for Bugatti Cars

Every car insurance plan is to be renewed after a certain period of time to continue to avail its benefits. If you could not renew it on time, your policy can get lapsed due to which your insurer would not remain eligible to settle your car insurance claims for the losses and damages caused to your Bugatti car. Besides, several insurance benefits will be terminated like No Claim Bonus (NCB), policy coverage and many more. In case of failing to renew the policy on time, you can renew it in the grace period without losing out on any of your car insurance policy benefits.

The expiration of policy comes with various hassles where you can be penalised with penalties or fines for late renewal. Also, driving a car without an active car insurance cover can also impose fines and punishment for not complying with legal requirements. However, every insurer provides a grace period option to get your car insurance plan renewed. The grace period is generally 90 days but it may vary from insurer to insurer. You can renew your policy during this period through online as well as offline mode. The online mode is always recommended as it is swift and simple. To renew your plan online, you just have to visit the website of your insurance company and enter your policy details, attach documents and make payment.

Bugatti Car Insurance FAQs

-

How long does it take to renew a Bugatti car insurance?

You can get your Bugatti car insurance renewed in just 5 minutes with InsuranceDekho.

-

Which all insurance add-ons should be bought with Bugatti cars

For Bugatti Insurance, The popular car insurance add-ons opted with Bugatti cars include zero depreciation add-on, engine cover, NCB (No Claim Bonus) cover and RSA (Road Side Assistance) cover among others.

-

From where can I purchase insurance for my Bugatti car

You can visit our website insurancedekho.com, compare all available premium quotes for Bugatti cars and select the one which best suits your requirements. With InsuranceDekho, get policy issued instantly.

-

Which insurer has the best claim settlement ratio for Bugatti cars?

Acko General Insurance, Bharti AXA General Insurance and ICICI Lombard General Insurance are among the car insurers who have registered impressive claim settlement ratio for Bugatti cars.

-

Is it compulsory to purchase third party car insurance for Bugatti cars?

Yes, you will have to buy a third party car insurance plan for your Bugatti car as it is compulsory for everyone to own at least a liability only cover while driving a car in India, as per the Indian Motor Tariff.